THE SOCIETY is a multi racial union of customers that acts as a business to other businesses. By leveraging its members’ combined buying power, it secures exclusive discounts, profit shares, and rebates. These savings are then invested into various businesses, creating lifelong income for every member.

THE SOCIETY is a non-profit organization established in 2013, originally known as Black Society Empowerment NPC, and formally registered in 2019. It serves as a platform for like-minded individuals who come together to collectively manage their regular expenses, generating rebates and profits. These profits are then reinvested into the mainstream economy to foster job creation, business opportunities, and wealth generation. Our mission is to create an ecosystem where individual members can generate revenue from their everyday expenses, promoting financial growth and sustainability. We aim to build a robust loyalty program that not only meets members’ expense needs but also offers them a platform to promote their products and services, encouraging community-driven economic empowerment.

At The Society, we are dedicated to creating a collaborative space for members to grow, invest, and thrive together.

The immediate value of a member lies in the representation they receive from the senior leadership, known as the Board of Directors (BOD). This board is composed of professionals such as actuaries, economists, bankers, equity fund managers, lawyers, who work to negotiate pricing structures with large businesses, analyze the spending patterns of each member, and identify those with similar spending habits to secure better pricing. Additionally, they provide financial advisory services, wealth seminars, workshops, and more.

Start your journey to financial freedom

Support Our Mission

We invite you to contribute R83 per month or R1,000 per year to help us continue delivering value to our members.

Your contribution will support:

The ongoing development and enhancement of our IT infrastructure and platform.

The operational needs of the organisation.

Marketing and member recruitment initiatives.

Analysis of member spending patterns to identify savings opportunities.

Product research and price negotiations to help members lower the cost of items they already purchase.

Thank you for your continued support in helping us build a stronger, more efficient community.

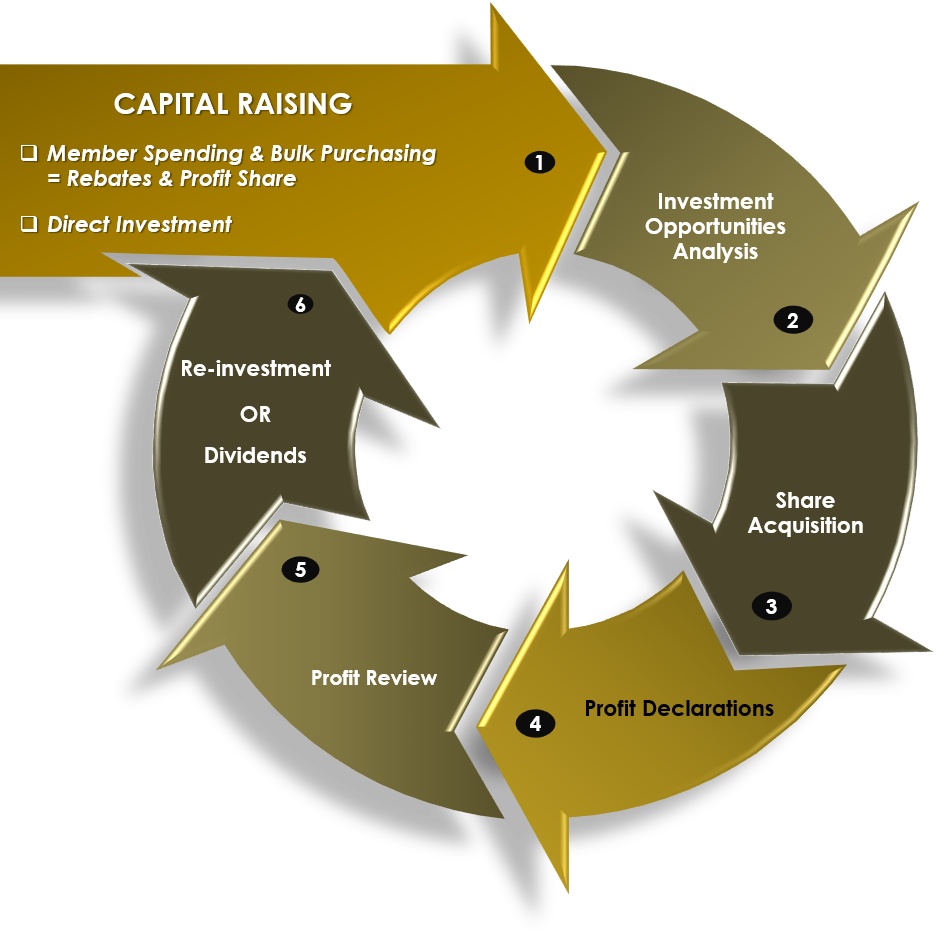

Direct investment capital in the form of crowd funding will be managed by reputable fund managers.

Indirect investment capital will be raised through rebates and profit share derived from each member spending.

Investment opportunities will be communicated via The Society platform/ website, emails and WhatsApp. This allows participants to engage with and contribute to specific investment opportunities on a push of a button.

Interested participants will submit their details electronically, which will be forwarded to the bank to activate the necessary stop orders. This step ensures that the investments are processed automatically, securely and ensures cost effectiveness .

Once the bank consolidates the collected funds from participants, they are transferred to a transaction advisor or fund manager. The financial advisor or manager must be registered with the Financial Sector Conduct Authority (FSCA), ensuring that the process adheres to regulatory standards.

The transaction advisor or fund manager will oversee the allocated capital, making investment decisions on behalf of the participants, aiming for optimal returns.

Indirect investment capital will be generated through rebates and profit shares associated with each member’s spending activities. Essentially, participants who make purchases through designated channels could earn rebates, which will be pooled into the overall fund.

In addition to the rebates, any profits derived from the collective investments or activities will be shared among the participants, offering them a return based on their spending and engagement within the system. This dual approach leverages both crowdfunding for direct capital infusion and incentivised spending for ongoing indirect capital generation. It ensures a diversified method for raising funds while keeping participants engaged in the process.

STANDARD MEMBERSHIP applies to all members of The Society. Digital crowd funding applies to every member, contributions starting from R5 to a maximum of R100, however managed via our banking partner.

The difference in membership categories based on the spending power that influences indirect investment capital raising and direct investment capability.

New Bank Account for Crowdfunding: A new bank account is required specifically for crowdfunding purposes to manage and track the funds. This ensures transparency and proper financial oversight.

Trust Account for Dividends: Once shares are distributed, a trust account is needed to handle and distribute dividends to shareholders. This ensures legal and ethical management of funds, benefiting members accordingly.

Establishment of a Will & Registration/Management of a Trust: Setting up a legal will is critical to ensure the proper distribution of assets upon death, while managing the trust ensures that investments are handled in accordance with the intentions of the members or stakeholders involved.

Survey on Spending (Allocate Teams): You may want to assign specific teams to assess and evaluate where and how funds are spent. This survey helps ensure that the investments are being used effectively, and any changes in expenditure are addressed properly.

Skills & Business Analysis, Member Profile: A detailed analysis of skills and business potential among members is essential for identifying their strengths and how they can contribute. This analysis will help tailor business opportunities to the right individuals.

Advertise Business & Professional Member Profiles (Connecting Opportunities): Creating profiles for business members to highlight their skills, expertise, and past work will attract potential business opportunities. Advertising these profiles can foster connections between members and external opportunities for growth.

SILVER MEMBERSHIP

Silver Membership is available to individuals who are registered members in good standing. These members have appointed by our FSP (Financial Services Provider) loyal partners for financial advisory services.

Key Benefits:

Capital Raising: Members can raise investment capital using qualifying expenses, which may attract rebates and profit-sharing opportunities.

Eligible Products: Members can participate in the following products:

Insurance

Legal Plan

Medical & Hospital Plans

Tyre Services

Glass Repairs

Banking Services

Eligibility Requirements:

Members must spend a minimum of R1500 and less than R2000 per month on insurance products.

GOLD MEMBERSHIP Gold Membership is available to individuals who are registered members in good standing. These members have appointed by our FSP (Financial Services Provider) loyal partners for financial advisory services.

Key Benefits: Capital Raising: Members can raise investment capital using qualifying expenses, which may attract rebates and profit-sharing opportunities.

Eligible Products: Members can participate in the following products:

Insurance

Legal Plan

Medical & Hospital Plans

Tyre Services

Glass Repairs

Banking Services

Eligibility Requirements:

Members must spend R5,000 or more per month on insurance products.

Members who are able to invest less than R20 000 annually in special projects will be eligible for exclusive investment opportunities.

These opportunities will be promoted by The Society and managed by a Fund Manager (FM).

PLATINUM MEMBERSHIP

Platinum Membership is available to individuals who are registered members in good standing. These members have appointed our FSP (Financial Services Provider) loyal partners for financial advisory services.

Key Benefits: Capital Raising: Members can raise investment capital using qualifying expenses, which may attract rebates and profit-sharing opportunities.

Eligible Products: Members can participate in the following products:

Insurance

Legal Plan

Medical & Hospital Plans

Tyre Services

Glass Repairs

Banking Services

Eligibility Requirements:

Members must spend R5,000 or more per month on insurance products. Members who are able to invest a minimum of R100,000 annually in special projects will be eligible for exclusive investment opportunities. These opportunities will be promoted by The Society and managed by a Fund Manager (FM).

Voice in the Economy

Financial Literacy Training

Access to Discounts

Profit from Spending

Create Investment Capital Through Rebates

Create Affordable Investment Opportunities

Access to Jobs

Access to Business Opportunities

Access to Funding

Access to Funding Guarantees

Affordable Housing Schemes

Affordable Health Care

Affordable Education

Affordable Insurance Products

Affordable Funeral Plan for the Elderly

Old Age Accommodation

Drugs and Alcohol Rehabilitation Centres

Talent Development

Registered members can log in with their unique details to view current opportunities, ensuring personalized access.

Limited Access for Non-Members: Non-members have restricted access to platform information, protecting sensitive data for registered users only.

Privacy Protection: The platform maintains privacy by preventing members from viewing each other’s financial information, such as expenses and gains.

Device Lock: Members’ logins are tied to a specific device used during registration. If they wish to access the platform from a different device, they must confirm the change via an email link for security verification.

These measures enhance user security and ensure controlled access to the platform.